How People Search Today: A Study on Evolving Search Behaviors in 2025

Key Takeaways

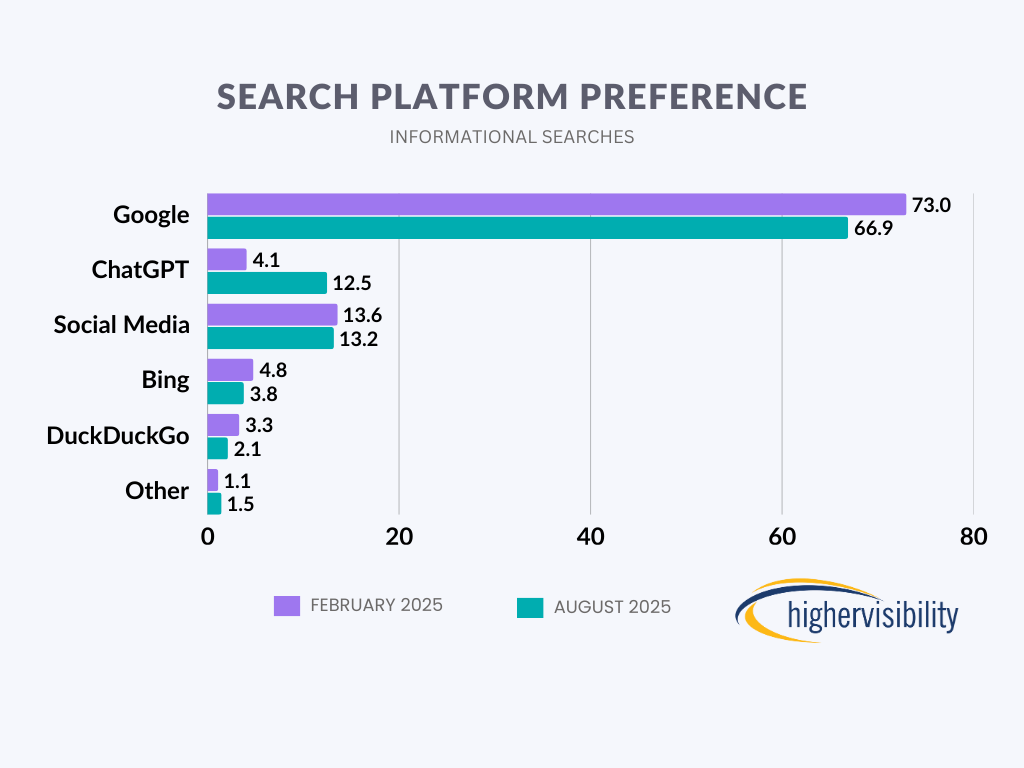

- Google's dominance in general information searches dropped from 73% to 66.9% in six months, indicating erosion of its market share.

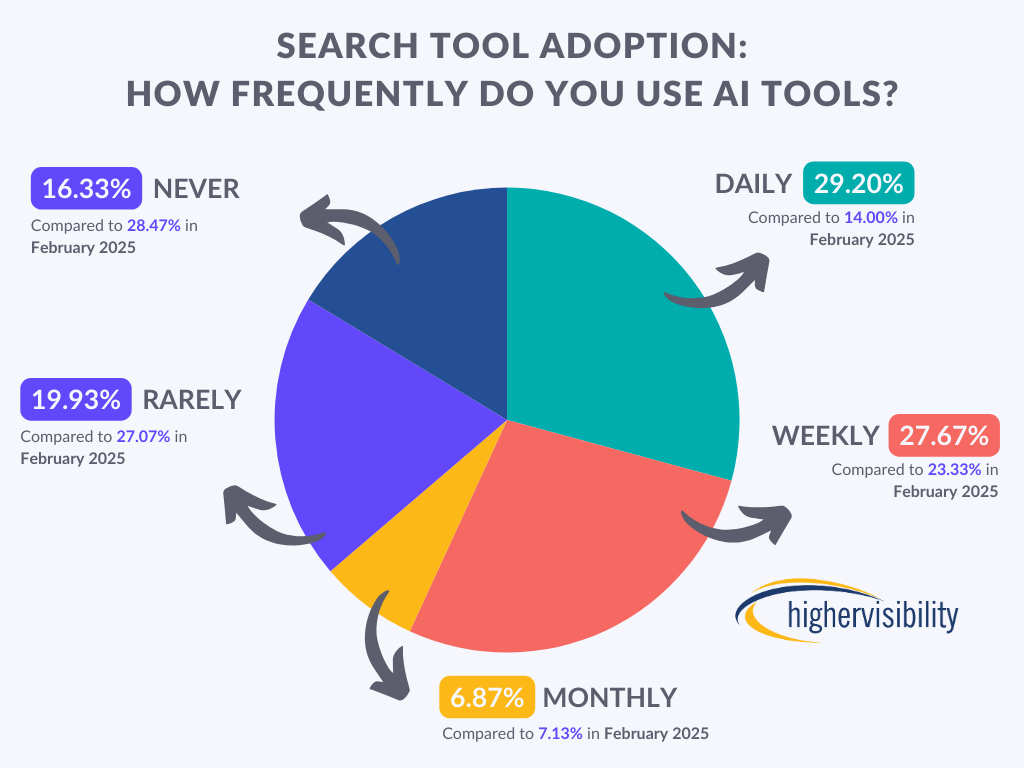

- AI tool adoption saw a significant increase, with daily usage more than doubling from 14% to 29.2%.

- ChatGPT usage for general searches tripled from 4.1% to 12.5%, aligning with OpenAI's reported 12% market share, showcasing a notable rise in this AI tool's popularity.

Editor’s Note: This post was originally published in February and has been updated for accuracy and comprehensiveness.

“SEO is dead” and “Google’s dominance is fading.” These bold claims have fueled debates across the digital marketing world. While Google’s global search market share recently dipped below 90% for the first time since 2015, our data reveals a more nuanced story.

Back in February 2025, we conducted a study to understand search behaviors. At the time, AI tools like ChatGPT were just beginning to emerge as potential alternatives to traditional search engines.

Six months later, our August follow-up study shows the pace of change has dramatically accelerated.

This report reveals how people’s search habits are shifting across platforms, intents, and generations, with clear signs that we’re not seeing gradual change, but rapid behavioral transformation.

Key Findings

- Google’s dominance is eroding: Share of general information searches dropped from 73% to 66.9% in six months

- AI adoption accelerated dramatically: Daily AI tool usage more than doubled from 14% to 29.2%

- ChatGPT usage tripled: Rose from 4.1% to 12.5% for general searches, aligning with OpenAI’s reported 12% market share

- Platform switching surged: 34.8% now report changing their search behavior (up from 27.7%)

- “Never used AI” users dropping fast: Declined from 28.5% to 16.3% of respondents

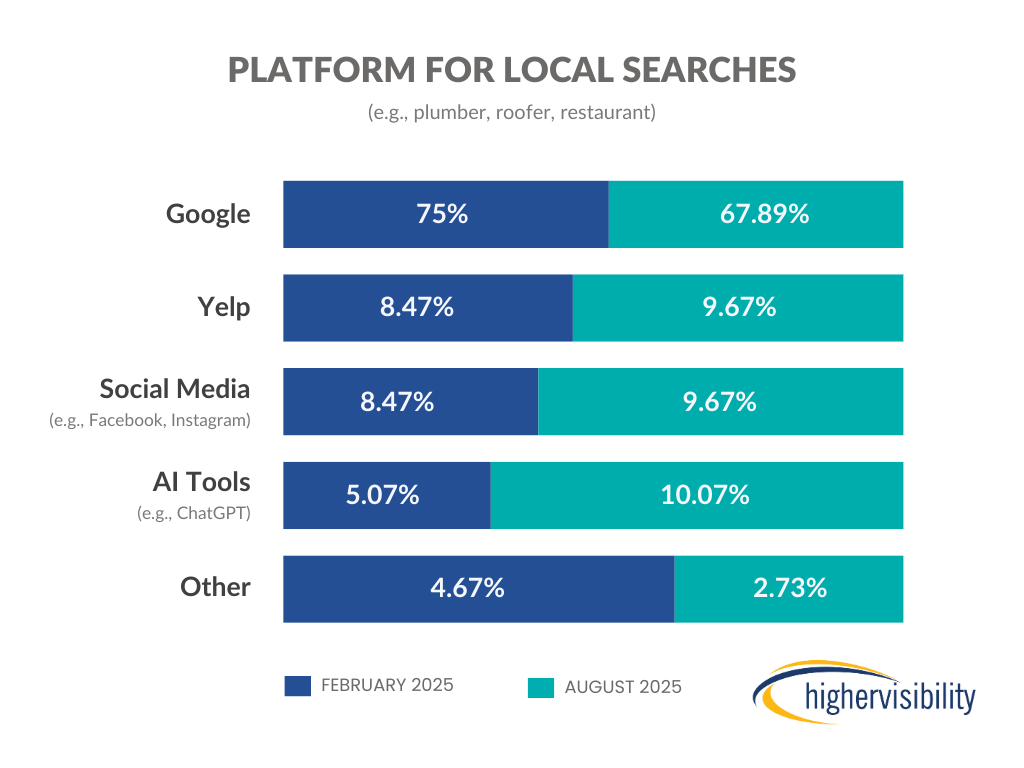

- AI penetrating local search: Usage doubled from 5.07% to 10.07% even in Google’s traditional stronghold

- Multi-platform strategies emerging: Users developing sophisticated approaches matching platforms to specific search intents

- Behavioral change awareness growing: 46.2% report feeling their search behavior has changed

The Acceleration Story: Key Findings

The Numbers Tell a Clear Story of Rapid Change

Our February baseline showed early experimentation. Six months later, the data reveals wholesale behavioral shifts:

- Google’s Declining Share: For general information searches, Google dropped from 73% to 66.9%, a significant 6-point decline in just six months

- ChatGPT’s Rise: Usage for general search tripled from 4.1% to 12.5%

- Platform Switching Accelerated: 34.8% now report changing their search behavior (up from 27.7%)

- AI Tool Adoption Surge: Daily AI usage more than doubled from 14% to 29.2%, while “never” users dropped from 28.47% to just 16.33%

What Users Are Actually Saying

The qualitative responses reveal a fundamental shift in user sentiment and expectations:

Speed and Efficiency Drive AI Adoption:

- “I started using ChatGPT over Google because it is faster”

- “Chat GPT, its faster and more precise”

- “ChatGPT because it provides more customized results based on my chat history”

Growing Google Fatigue:

- “Google search isn’t as powerful and its image search is useless now”

- “I use google more because facebook searching leads to misinformation more times than not”

- “Bing because they don’t do the AI summary” (showing backlash against Google’s AI integration)

Platform Sophistication Emerges:

- “I use chatgpt, gemini, claude”

- “I now also search on open ai like chatgpt… because it is very fast and comes with every details”

Platform Preferences by Search Intent

1. General Information Searches

- Google: 66.9% (down from 73% in February)

- ChatGPT: 12.5% (up from 4.1%)

- Social Media: 13.2% (steady)

- Bing: 3.8%

- Other: 3.6%

2. Shopping Searches

- Amazon: Continues to lead for direct product searches

- Google: Maintains strength for initial product research

- AI Tools: Growing role in product comparisons and recommendations

- Social Media: Increasingly important for discovery-based shopping

3. Local Business Searches

- Google: Dominates with 67.80% (down from 75% in February)

- Yelp: 9.67% (up from 8.47%)

- Social Media: 9.67% (up from 8.47%)

- AI Tools: 10.07% (up from 5.07% – doubling in local search usage)

The data shows that AI tools are beginning to penetrate even local searches, which are traditionally one of Google’s strongest moats.

The Generational Divide: Who’s Leading the Change

Gen Z (18-24): The AI Natives

- Sharpest increase in ChatGPT adoption

- Frequently blend TikTok and Instagram for product discovery

- Comfortable with multi-platform search strategies

- Leading the charge in abandoning Google-first behavior

Millennials (25-40): The Efficiency Seekers

- Notable rise in AI usage for productivity and decision-making

- Still use Google for practical needs but increasingly diversify

- Quick to adopt AI for research and professional tasks

- Show highest satisfaction with blended search approaches

Gen X (41-56): The Cautious Adopters

- Continued Google reliance but modest ChatGPT experimentation

- AI adoption primarily for educational or technical queries

- More gradual transition but showing consistent growth

Boomers (57+): The Traditionalists

- Slowest to switch platforms but adoption is growing

- When they do adopt AI, they report high satisfaction

- Prefer clear, simple interfaces and proven platforms

AI Tool Usage Patterns: Beyond the Hype

Most Common AI Use Cases:

- General knowledge: 40.3%

- Writing assistance: 19.0%

- Product recommendations: 14.8%

- Local recommendations: 11.6%

- Coding/technical help: 8.4%

Frequency of AI Tool Use:

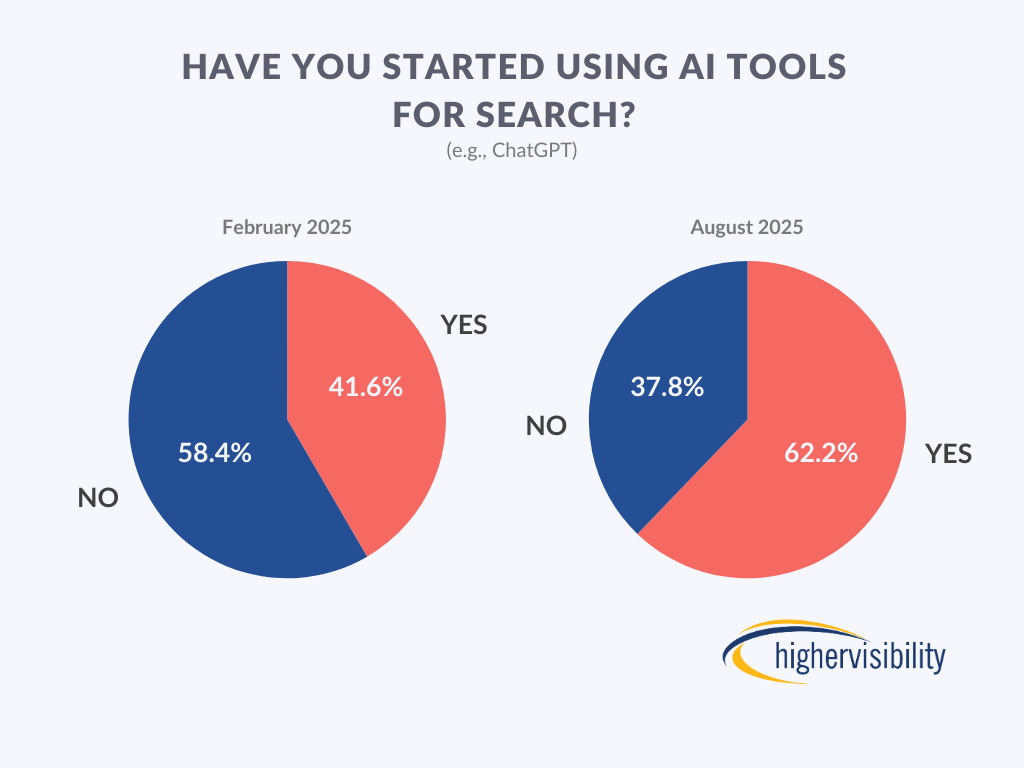

The shift from 41.6% to 62.2% using AI tools for search represents one of the fastest technology adoption curves we’ve measured:

- Daily: 29.2% (doubled from 14% in February)

- Weekly: 27.7%

- Monthly: 6.9%

- Rarely: 19.9%

- Never: 16.3% (down from 28.5% in February)

The “Never Users” Are Disappearing Fast: The 12-point drop in “never used AI” represents one of the most significant behavioral shifts we’ve measured. This suggests AI adoption is moving from early adopters to mainstream acceptance.

External Validation: Industry Data Confirms Our Findings

Our survey data showing ChatGPT capturing 12.5% of general information searches aligns remarkably with recent industry reports. OpenAI’s CFO Sarah Friar recently stated on CNBC that ChatGPT has grown from “something like 6% share overall to 12% in six months.”

Notably, Friar suggested search share may be underestimated: “When you are doing a conversational search in ChatGPT, you probably go back and forth five, six times. That doesn’t count as five, six searches, which is what Google would count as. It counts as one.”

This insight supports our qualitative findings about user behavior. People are engaging in more complex, multi-turn conversations with AI tools rather than performing multiple separate searches, representing a fundamental shift in search methodology rather than simple platform switching.

What This Means for Businesses

1. The Multi-Platform Imperative

Traditional SEO focused on Google rankings. The new reality requires visibility across:

- Google for navigational and local searches

- AI platforms for explanatory and research queries

- Social media for discovery and trend-based searches

- Specialized platforms for niche and transactional searches

2. Content Strategy Evolution

Content must now be optimized for:

- Traditional search engines (keywords, technical SEO)

- AI summarization (clear, structured, authoritative information)

- Social discovery (engaging, shareable formats)

- Voice and conversational queries

3. The Speed of Change Demands Urgency

Our February study suggested gradual adaptation would suffice. The August data shows businesses need to act immediately:

- AI daily usage could reach 40-50% by early 2026 at current growth rates

- Google’s dominance will continue eroding as users develop platform-specific habits

- The window for gradual adaptation is closing rapidly

User Satisfaction: The Multi-Platform Winners

Satisfaction Levels (August 2025):

- Very satisfied: 53.1% (up from 48.7% in February)

- Somewhat satisfied: 31.2%

- Neutral: 11.5%

- Somewhat dissatisfied: 2.5%

- Very dissatisfied: 1.8%

The increase in satisfaction appears directly correlated with users who’ve adopted blended search strategies, using both traditional and AI tools rather than relying on a single platform.

Looking Forward: A More Complex Reality

While our data shows clear behavioral shifts, Google’s response suggests the competitive landscape is more nuanced than simple displacement:

Google’s Counter-Strategy:

Recent Google announcements reveal significant AI integration efforts:

- AI Overviews now reach 1.5 billion users monthly across 100+ countries

- Circle to Search grew 40% quarter-over-quarter to 250 million devices

- Google Lens searches increased by 5 billion since October 2024

- Overall query growth continues, including increases from Apple devices

What This Means for Trends:

- Continued fragmentation across platforms, but with Google fighting back through AI integration

- Multi-platform strategies becoming standard, particularly among younger users

- Conversational search growing across all major platforms, not just ChatGPT

- Visual and voice search expanding as Google Lens and Circle to Search gain traction

The Evolving Search Ecosystem:

Rather than simple platform switching, we’re seeing:

- Platform specialization based on user intent and context

- AI integration becoming standard across all major search platforms

- Competition driving innovation in search interfaces and capabilities

- User behavior diversification rather than wholesale platform abandonment

Conclusion: Evolution vs Revolution

Our February study suggested we were witnessing the early stages of search behavior evolution. The August data reveals we were actually documenting the beginning of a revolution.

The changes aren’t just about adopting new tools; they represent a fundamental shift in how people think about finding information. Users are no longer defaulting to a single search engine; they’re developing sophisticated strategies that match specific platforms to specific needs.

For businesses, this means the era of Google-only SEO strategies is ending. Success now requires understanding and optimizing for a fragmented, multi-platform search landscape where different audiences use different tools for different purposes.

SEO isn’t dead, but it’s no longer just about ranking in Google. It’s about being discoverable wherever your audience searches, and that landscape is expanding and evolving faster than most predicted.

Fair Use Statement

Feel free to share these findings for non-commercial purposes, provided you link back to this original source.

Methodology

This study compares data from two identical surveys of 1,500 U.S.-based participants conducted in February and August 2025. Responses reflect a diverse range of ages, geographic regions, and demographics to ensure representative insights. The use of identical methodology allows for valid comparison and trend analysis.

Research conducted by HigherVisibility. For more information or detailed data breakdowns, contact our research team.